Introduction

Definition of Blockchain

Blockchain is a decentralized and distributed digital ledger technology that securely records and verifies transactions across multiple computers or nodes. It is characterized by its transparency, immutability, and tamper-proof nature, making it an ideal solution for financial services. By eliminating the need for intermediaries and providing a secure and efficient way to transfer assets, blockchain has the potential to revolutionize the financial industry by increasing transparency, reducing costs, and improving trust among participants.

Overview of Financial Services

The financial services industry plays a crucial role in the global economy, providing various services such as banking, insurance, investment management, and more. In recent years, the emergence of blockchain technology has disrupted the traditional financial landscape, offering new opportunities and challenges. Blockchain, a decentralized and transparent ledger system, has the potential to revolutionize financial services by increasing efficiency, security, and trust in transactions. This technology enables faster and cheaper cross-border payments, eliminates intermediaries, and enhances the traceability of financial transactions. As a result, financial institutions are exploring the implementation of blockchain to streamline processes, reduce costs, and improve customer experiences. The adoption of blockchain in financial services is expected to reshape the industry and create a more inclusive and accessible financial ecosystem.

Importance of Blockchain in Financial Services

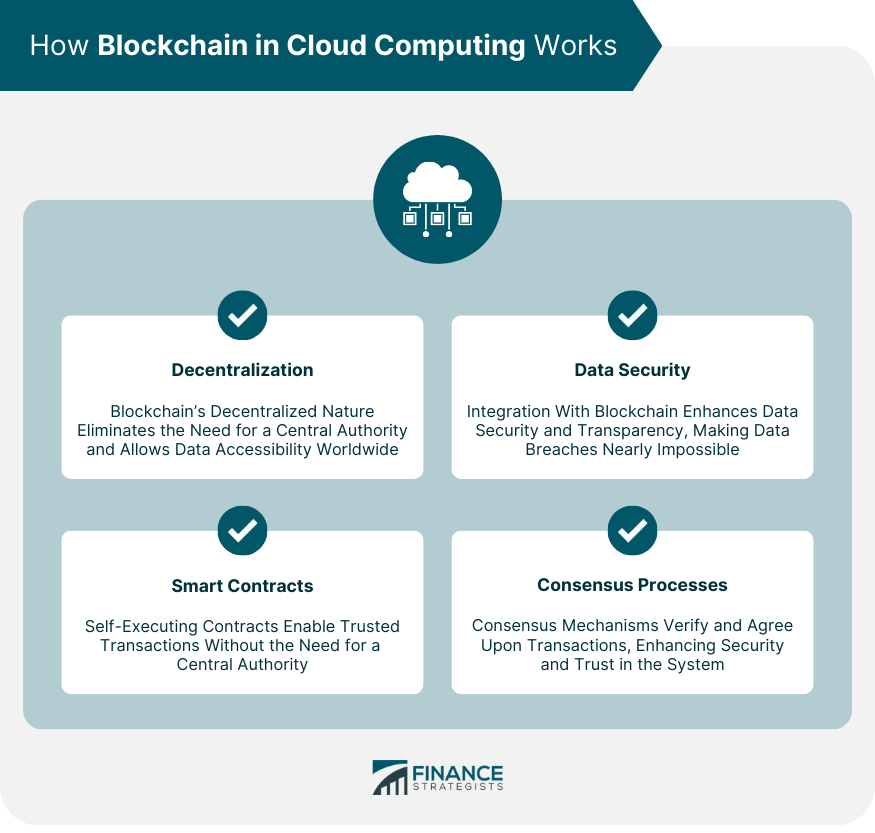

Blockchain technology has revolutionized the financial services industry by offering a secure and transparent way to conduct transactions. The importance of blockchain in financial services cannot be overstated as it has the potential to enhance efficiency, reduce costs, and mitigate risks. With blockchain, financial institutions can streamline processes such as payments, remittances, and identity verification, leading to faster and more reliable transactions. Additionally, the decentralized nature of blockchain eliminates the need for intermediaries, reducing the chances of fraud and increasing trust among participants. Overall, the adoption of blockchain in financial services is crucial for creating a more inclusive and resilient financial system.

Benefits of Blockchain in Financial Services

Increased Security and Transparency

Increased security and transparency are two key benefits that blockchain technology brings to the financial services industry. By utilizing a decentralized and immutable ledger, blockchain ensures that transactions are secure and tamper-proof. This eliminates the need for intermediaries, such as banks, to validate and record transactions, reducing the risk of fraud and human error. Additionally, the transparent nature of blockchain allows for real-time visibility into the entire transaction history, providing a level of trust and accountability that is unparalleled in traditional financial systems. As a result, blockchain has the potential to revolutionize the way financial services are conducted, making them more secure and transparent for all stakeholders involved.

Reduced Costs and Improved Efficiency

Blockchain technology has revolutionized the financial services industry by reducing costs and improving efficiency. With its decentralized and transparent nature, blockchain eliminates the need for intermediaries, such as banks or payment processors, resulting in significant cost savings. Additionally, the automation of processes through smart contracts streamlines operations, reducing the time and resources required for manual tasks. This increased efficiency not only benefits financial institutions but also enhances the overall customer experience by enabling faster transactions and reducing the risk of errors or fraud. As a result, blockchain has become a game-changer in the financial services sector, paving the way for a more cost-effective and streamlined future.

Streamlined Processes and Faster Transactions

Blockchain technology has revolutionized the financial services industry by introducing streamlined processes and faster transactions. With traditional banking systems, transactions often require multiple intermediaries, resulting in delays and higher costs. However, blockchain eliminates the need for intermediaries by providing a decentralized and transparent ledger. This allows for peer-to-peer transactions that are executed quickly and securely, reducing the time and cost associated with traditional financial processes. Additionally, blockchain’s immutability ensures that transactions cannot be altered or tampered with, providing a high level of trust and security. As a result, financial institutions are increasingly adopting blockchain technology to enhance efficiency, reduce costs, and improve customer experiences.

Challenges and Limitations of Blockchain in Financial Services

Regulatory and Legal Challenges

The implementation of blockchain technology in the financial services sector has brought about numerous benefits, such as increased efficiency, transparency, and security. However, alongside these advantages, there are also regulatory and legal challenges that need to be addressed. One of the main challenges is the lack of clear regulations surrounding blockchain technology, as it is a relatively new and rapidly evolving field. This uncertainty can create hurdles for financial institutions and businesses looking to adopt blockchain solutions, as they need to ensure compliance with existing laws and regulations. Additionally, the decentralized nature of blockchain poses challenges in terms of data protection and privacy, as it may be difficult to determine liability in case of a breach or unauthorized access. To overcome these challenges, regulatory bodies and lawmakers need to work closely with industry stakeholders to develop comprehensive and adaptable frameworks that strike a balance between innovation and consumer protection.

Scalability and Performance Issues

Scalability and performance are crucial factors to consider when implementing blockchain technology in the financial services industry. As the number of transactions and participants on the blockchain network increases, it is important to ensure that the system can handle the growing demand without compromising its efficiency. Blockchain technology has faced challenges in terms of scalability and performance, with issues such as slow transaction processing times and limited throughput. However, advancements in blockchain protocols and the development of off-chain solutions are addressing these concerns and improving the scalability and performance of blockchain networks. By implementing innovative solutions like sharding, layer 2 scaling, and consensus algorithms, financial institutions can overcome scalability and performance issues and harness the full potential of blockchain technology for secure, transparent, and efficient financial services.

Integration with Legacy Systems

Blockchain technology has the potential to revolutionize the financial services industry by offering a secure and transparent way to record and verify transactions. One of the key challenges in implementing blockchain in financial services is the integration with legacy systems. Legacy systems are the existing systems and processes that have been in place for many years and are often outdated and incompatible with newer technologies. However, integrating blockchain with legacy systems is crucial for the successful adoption of this technology. It requires careful planning and coordination to ensure that the new blockchain infrastructure can seamlessly work with the existing systems, enabling organizations to leverage the benefits of blockchain while minimizing disruption to their operations. By integrating blockchain with legacy systems, financial institutions can streamline their processes, improve efficiency, and enhance security, ultimately transforming the way they operate and deliver services to their customers.

Use Cases of Blockchain in Financial Services

Cross-Border Payments and Remittances

Cross-border payments and remittances are one of the key areas where blockchain technology has the potential to revolutionize the financial services industry. Traditional cross-border payments are often slow, expensive, and subject to intermediaries, resulting in delays and high transaction costs. With blockchain, transactions can be executed directly between parties, eliminating the need for intermediaries and reducing costs. Additionally, blockchain technology provides increased transparency and security, ensuring that transactions are traceable and tamper-proof. This has the potential to make cross-border payments faster, more efficient, and more accessible for individuals and businesses around the world. As blockchain continues to evolve, it is expected to play a major role in transforming the cross-border payments and remittances landscape, making it more seamless and cost-effective for everyone involved.

Smart Contracts and Digital Identity

Smart contracts and digital identity play a crucial role in the implementation of blockchain technology in financial services. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, enable automated and secure transactions without the need for intermediaries. This not only reduces costs but also increases efficiency and transparency in financial processes. Additionally, digital identity solutions built on blockchain technology provide a secure and verifiable way to authenticate individuals, ensuring that only authorized parties can access and engage in financial transactions. By combining the power of smart contracts and digital identity, blockchain has the potential to revolutionize the way financial services are conducted, making them more accessible, efficient, and secure.

Supply Chain Finance and Trade Settlement

Supply Chain Finance and Trade Settlement is a critical area where blockchain technology can revolutionize the financial services industry. Traditionally, supply chain finance and trade settlement processes have been complex, time-consuming, and prone to errors. However, by leveraging blockchain, these processes can be streamlined, automated, and made more secure. Blockchain allows for the creation of a transparent and immutable ledger that all parties involved in the supply chain can access and verify. This eliminates the need for intermediaries and reduces the risk of fraud or disputes. Additionally, smart contracts can be used to automatically execute trade settlements based on predefined conditions, further improving efficiency and reducing costs. Overall, blockchain has the potential to greatly enhance supply chain finance and trade settlement, providing benefits such as increased transparency, reduced risk, and improved efficiency.

Future Trends and Opportunities

Integration with Internet of Things (IoT)

Blockchain technology has the potential to revolutionize the integration with Internet of Things (IoT) in the financial services industry. By combining the decentralized and secure nature of blockchain with the vast network of interconnected devices in IoT, financial institutions can enhance data integrity, transparency, and security. With blockchain, IoT devices can securely communicate and transact with each other, eliminating the need for intermediaries and reducing transaction costs. Additionally, blockchain can enable real-time auditing and tracking of IoT devices, ensuring compliance and accountability. The integration of blockchain and IoT has the potential to streamline processes, improve efficiency, and create new business models in the financial services sector.

Central Bank Digital Currencies (CBDCs)

Central Bank Digital Currencies (CBDCs) are a form of digital currency issued and regulated by a country’s central bank. With the rise of blockchain technology, CBDCs have gained significant attention in the financial services industry. These digital currencies have the potential to revolutionize the way we transact and store value, offering benefits such as increased efficiency, transparency, and security. CBDCs can provide individuals and businesses with a faster and cheaper alternative to traditional banking systems, enabling instant and borderless transactions. Additionally, CBDCs can help governments in combating illicit activities such as money laundering and tax evasion, as every transaction is recorded on the blockchain. As the financial landscape continues to evolve, central banks around the world are exploring the feasibility and potential implementation of CBDCs, aiming to harness the benefits of blockchain technology in the financial sector.

Decentralized Finance (DeFi)

Decentralized Finance (DeFi) is a revolutionary concept that aims to transform traditional financial systems by leveraging blockchain technology. Unlike traditional finance, which relies on centralized intermediaries such as banks, DeFi operates on a decentralized network of smart contracts, allowing for greater transparency, security, and accessibility. Through DeFi, individuals can access a wide range of financial services, including lending, borrowing, trading, and investing, without the need for intermediaries. This decentralized nature also enables anyone with an internet connection to participate in the global financial system, regardless of their location or socioeconomic status. As blockchain technology continues to evolve, DeFi is expected to play a significant role in reshaping the future of financial services, making them more inclusive, efficient, and resilient.

Conclusion

Summary of Key Points

Blockchain technology has revolutionized the financial services industry by providing secure and transparent transactions. It has eliminated the need for intermediaries and centralized authorities, reducing costs and increasing efficiency. With blockchain, financial institutions can ensure the integrity of data and prevent fraud, making transactions more reliable. Additionally, blockchain enables faster cross-border transactions, improving financial inclusion and accessibility. Overall, the adoption of blockchain in financial services has the potential to transform the industry, enhancing trust, security, and efficiency.

Potential Impact on Financial Services

Blockchain technology has the potential to revolutionize the financial services industry in several ways. One of the key impacts is the increased efficiency and transparency it can bring to financial transactions. By using blockchain, financial institutions can streamline their processes, reduce costs, and eliminate the need for intermediaries. Additionally, the decentralized nature of blockchain ensures that transactions are secure and tamper-proof, providing a higher level of trust and confidence for both businesses and consumers. Furthermore, blockchain can enable faster and more cost-effective cross-border transactions, removing the barriers and delays associated with traditional banking systems. Overall, the potential impact of blockchain on financial services is immense, promising a more efficient, secure, and inclusive financial ecosystem.

Future Outlook

The future outlook for blockchain in financial services is promising. As the technology continues to mature and gain acceptance, it is expected to revolutionize the way financial transactions are conducted. Blockchain has the potential to increase efficiency, transparency, and security in financial services, leading to reduced costs and improved customer experiences. Additionally, blockchain can enable new business models and opportunities, such as decentralized finance and smart contracts. However, challenges such as regulatory concerns and scalability issues need to be addressed for widespread adoption. Overall, the future of blockchain in financial services holds great potential for transforming the industry and creating new possibilities for financial innovation.