Introduction

Definition of decentralized financial systems

Decentralized financial systems, also known as DeFi, refer to the use of blockchain technology and smart contracts to create financial applications that operate without the need for intermediaries or centralized authorities. In a decentralized financial system, transactions and financial activities are conducted directly between participants on the network, eliminating the need for traditional banks or financial institutions. This enables greater transparency, security, and efficiency in financial transactions, as well as providing access to financial services for individuals who may be excluded from the traditional banking system. With the rise of cryptocurrencies and blockchain technology, decentralized financial systems are poised to revolutionize the way we think about and interact with finance in the future.

Importance of decentralized financial systems

Decentralized financial systems have emerged as a crucial component in shaping the future of finance. With the rise of blockchain technology, these systems offer a new paradigm that challenges traditional centralized models. The importance of decentralized financial systems lies in their ability to provide greater financial inclusion, security, and transparency. By eliminating intermediaries and enabling peer-to-peer transactions, these systems empower individuals and communities to have direct control over their financial assets. Moreover, the use of smart contracts ensures trust and eliminates the need for third-party verification. As the world becomes more interconnected and digital, decentralized financial systems are poised to revolutionize the way we conduct financial transactions and participate in the global economy.

Overview of the article

In this article, we will explore the future of finance in the context of decentralized financial systems. Decentralized finance, also known as DeFi, is a rapidly growing sector that aims to revolutionize traditional financial systems by leveraging blockchain technology. It offers a range of financial services, such as lending, borrowing, trading, and investing, without the need for intermediaries like banks or brokers. This article will provide an overview of the key concepts and benefits of decentralized financial systems and discuss their potential impact on the global financial landscape. We will also examine the challenges and risks associated with DeFi and explore the regulatory considerations that need to be addressed for its widespread adoption. By the end of this article, readers will have a deeper understanding of the transformative potential of decentralized financial systems and the opportunities they present for individuals and businesses alike.

Current Challenges in Traditional Finance

Centralization of power and control

Centralization of power and control has long been a defining characteristic of traditional financial systems. However, with the emergence of decentralized financial systems, this paradigm is being challenged. Decentralized finance, or DeFi, aims to democratize the financial landscape by removing intermediaries and allowing individuals to have direct control over their assets. This shift towards decentralization not only promotes transparency and trust, but also opens up new opportunities for financial inclusion and innovation. By leveraging blockchain technology, decentralized financial systems have the potential to revolutionize the way we think about and interact with money. As we look to the future, it is clear that the centralized model of finance is no longer sustainable, and embracing the decentralized approach is crucial for a more equitable and resilient financial system.

Lack of transparency

Lack of transparency in traditional financial systems has long been a concern for individuals and institutions alike. The opacity of these systems has allowed for hidden fees, undisclosed conflicts of interest, and a lack of accountability. However, with the rise of decentralized financial systems, the future of finance is looking much brighter. These systems, built on blockchain technology, offer a level of transparency that is unprecedented in the financial world. Every transaction is recorded on a public ledger, ensuring that all participants have access to the same information. This increased transparency not only promotes trust and confidence in the system but also enables individuals to make more informed financial decisions. As decentralized financial systems continue to evolve, we can expect to see a shift towards a more transparent and equitable financial landscape.

Inefficiencies and high costs

Inefficiencies and high costs have long plagued traditional financial systems, hindering their ability to provide efficient and cost-effective services. Centralized financial institutions often face challenges such as slow transaction processing, high fees, and limited accessibility. These inefficiencies not only inconvenience individuals and businesses but also create barriers to financial inclusion, particularly for the unbanked and underbanked populations. However, with the emergence of decentralized financial systems, there is hope for a more efficient and inclusive future of finance. By leveraging blockchain technology and smart contracts, decentralized financial systems aim to eliminate intermediaries, reduce transaction costs, and enhance financial accessibility for all. Through decentralized finance, individuals and businesses can enjoy faster, cheaper, and more transparent financial services, ultimately ushering in a new era of financial innovation and empowerment.

Benefits of Decentralized Financial Systems

Increased financial inclusivity

Increased financial inclusivity is one of the most significant advantages of decentralized financial systems. These systems have the potential to provide access to financial services for individuals who are currently excluded from the traditional banking system. With decentralized financial systems, people can participate in financial activities, such as lending, borrowing, and investing, without the need for intermediaries or extensive documentation. This opens up opportunities for individuals in underserved communities and developing countries to access capital and improve their financial well-being. By enabling financial inclusivity, decentralized financial systems have the power to create a more equitable and accessible financial landscape for all.

Enhanced security and privacy

Enhanced security and privacy are two crucial aspects that decentralized financial systems bring to the future of finance. With traditional financial systems, there is always a risk of data breaches and unauthorized access to sensitive information. However, decentralized financial systems utilize advanced encryption techniques and distributed ledger technology to ensure that user data is securely stored and transactions are confidential. This enhanced security and privacy not only protect individuals’ financial information but also foster trust and confidence in the financial system as a whole. As the world becomes increasingly digital, the need for robust security and privacy measures is paramount, and decentralized financial systems are at the forefront of providing these solutions.

Reduced intermediaries and costs

In the future of finance, decentralized financial systems are expected to significantly reduce the number of intermediaries involved in financial transactions, leading to lower costs for individuals and businesses. Traditional financial systems often rely on multiple intermediaries such as banks, payment processors, and clearinghouses, which can result in delays, additional fees, and a lack of transparency. However, with decentralized financial systems built on blockchain technology, transactions can be conducted directly between parties, eliminating the need for intermediaries. This not only streamlines the process but also reduces costs by eliminating the fees associated with intermediaries. As a result, individuals and businesses can benefit from faster, more efficient, and cost-effective financial transactions in the future.

Key Components of Decentralized Financial Systems

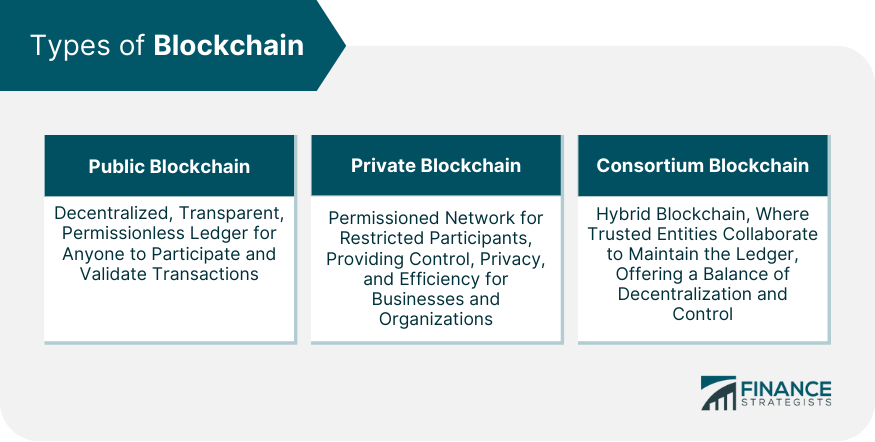

Blockchain technology

Blockchain technology has revolutionized the financial industry by providing a decentralized and transparent system for conducting financial transactions. With blockchain, financial transactions can be securely recorded and verified without the need for intermediaries such as banks or payment processors. This technology has the potential to disrupt traditional financial systems by reducing costs, increasing efficiency, and improving security. Additionally, blockchain enables the creation of smart contracts, which are self-executing agreements that automatically enforce the terms and conditions outlined in the contract. This eliminates the need for third-party intermediaries and reduces the risk of fraud or manipulation. As a result, blockchain technology is expected to play a significant role in shaping the future of finance, enabling new financial products and services, and empowering individuals to have more control over their financial transactions.

Smart contracts

Smart contracts are the backbone of decentralized financial systems. These self-executing contracts are coded to automatically execute transactions when predefined conditions are met. By eliminating the need for intermediaries, smart contracts enable faster, more efficient, and secure financial transactions. They have the potential to revolutionize the way we conduct business and manage financial assets. With the rise of blockchain technology, smart contracts are becoming increasingly popular in various industries, including banking, insurance, and supply chain management. As the future of finance unfolds, smart contracts will play a crucial role in creating a decentralized and transparent financial ecosystem.

Decentralized applications (DApps)

Decentralized applications (DApps) are revolutionizing the financial industry by providing a more secure and transparent way of conducting financial transactions. These applications leverage blockchain technology to eliminate the need for intermediaries, such as banks or payment processors, and allow users to directly interact with each other. By removing the middlemen, DApps enable faster and cheaper transactions, as well as greater control over personal financial data. Additionally, DApps offer a level playing field for all participants, regardless of their geographical location or financial status. As the adoption of DApps continues to grow, we can expect to see a significant transformation in the way we manage and access financial services.

Use Cases of Decentralized Financial Systems

Decentralized lending and borrowing

Decentralized lending and borrowing is revolutionizing the financial industry by providing an alternative to traditional banking systems. With decentralized financial systems, individuals can lend and borrow directly from each other, eliminating the need for intermediaries such as banks. This not only reduces costs but also increases accessibility and inclusivity, as anyone with an internet connection can participate in the lending and borrowing activities. Additionally, decentralized lending and borrowing platforms leverage blockchain technology to ensure transparency, immutability, and security of transactions. As a result, individuals have more control over their financial activities and can explore new opportunities in the decentralized finance space.

Decentralized exchanges

Decentralized exchanges are revolutionizing the world of finance by providing a secure and transparent platform for trading digital assets. Unlike traditional exchanges, which rely on intermediaries to facilitate transactions, decentralized exchanges operate on blockchain technology, eliminating the need for third-party involvement. This not only reduces the risk of fraud and manipulation but also enables users to have full control over their funds. With decentralized exchanges, individuals can trade directly with each other, fostering a peer-to-peer economy that is more inclusive and accessible. As the future of finance continues to evolve, decentralized exchanges are poised to play a significant role in shaping the way we transact and interact with digital assets.

Decentralized asset management

Decentralized asset management is set to revolutionize the finance industry. With the advent of blockchain technology and smart contracts, individuals will have the power to manage their assets in a secure and transparent manner. Traditional financial systems rely on intermediaries such as banks and investment firms, which often come with high fees and limited accessibility. However, decentralized financial systems eliminate the need for intermediaries, allowing for direct peer-to-peer transactions and greater control over one’s finances. This not only reduces costs but also enhances financial inclusion by providing access to financial services for the unbanked population. As decentralized asset management continues to evolve, we can expect to see a shift towards a more equitable and efficient financial ecosystem.

Challenges and Future Outlook

Regulatory concerns

Regulatory concerns play a crucial role in shaping the future of decentralized financial systems. As these systems operate outside traditional financial frameworks, regulators face the challenge of ensuring consumer protection, preventing money laundering, and maintaining financial stability. One of the key concerns is the potential for illicit activities facilitated by decentralized finance, such as fraud and terrorism financing. To address these concerns, regulators are actively exploring ways to implement robust regulatory frameworks that strike a balance between innovation and safeguarding the financial system. By establishing clear guidelines and monitoring mechanisms, regulators can foster the growth of decentralized financial systems while mitigating potential risks.

Scalability issues

Scalability issues have become a significant concern in the world of decentralized financial systems. As the popularity and adoption of these systems continue to grow, the need for efficient and scalable solutions becomes more apparent. The current infrastructure of decentralized finance often struggles to handle a high volume of transactions, resulting in slow processing times and increased fees. However, developers and innovators are actively working on addressing these challenges by implementing layer 2 solutions, such as sidechains and state channels, that aim to improve scalability without compromising security. These advancements hold the promise of unlocking the full potential of decentralized financial systems, allowing for seamless and rapid transactions on a global scale.

Integration with traditional finance

Integration with traditional finance is a crucial aspect of the future of decentralized financial systems. While decentralized finance offers numerous advantages such as transparency, security, and accessibility, it is important to bridge the gap between traditional financial institutions and decentralized platforms. This integration will not only enable the seamless transfer of assets between traditional and decentralized systems but also foster the adoption of decentralized finance by a wider audience. By incorporating traditional financial services into decentralized platforms, users can benefit from the best of both worlds, leveraging the efficiency and innovation of decentralized systems while still having the familiarity and stability of traditional finance. As decentralized financial systems continue to evolve and gain traction, the integration with traditional finance will play a pivotal role in shaping the future of the financial industry.