Introduction

What is blockchain?

Blockchain is a revolutionary technology that has gained significant attention in recent years. It is a decentralized and distributed ledger system that allows for secure and transparent transactions. Unlike traditional centralized systems, blockchain eliminates the need for intermediaries, such as banks or governments, by enabling peer-to-peer transactions. The technology behind blockchain ensures that each transaction is recorded and verified by multiple participants, making it virtually impossible to alter or tamper with the data. This makes blockchain an ideal solution for industries that require trust, security, and transparency, such as finance, supply chain management, and healthcare. By understanding the fundamentals of blockchain, investors can make informed decisions when it comes to investing in blockchain projects.

Why invest in blockchain projects?

Investing in blockchain projects can offer numerous benefits for both beginners and experienced investors. One of the key reasons to invest in blockchain projects is the potential for high returns. The blockchain industry has witnessed significant growth in recent years, with many successful projects generating substantial profits for their investors. Additionally, investing in blockchain projects provides an opportunity to support innovative technologies that have the potential to revolutionize various industries. Blockchain technology offers increased transparency, security, and efficiency, which can disrupt traditional business models and create new opportunities for growth. Moreover, investing in blockchain projects allows investors to diversify their portfolios and reduce risk by gaining exposure to a rapidly evolving and promising sector. With the increasing adoption of blockchain technology across various sectors, investing in blockchain projects can be a strategic move to capitalize on this transformative technology and potentially reap significant rewards.

Benefits of investing in blockchain projects

Blockchain technology has revolutionized various industries, and investing in blockchain projects offers numerous benefits. One of the key advantages is the potential for high returns. As blockchain projects continue to gain traction, their value and demand increase, leading to potential profits for investors. Additionally, investing in blockchain projects provides an opportunity to support innovative solutions and disruptive technologies. By backing these projects, investors contribute to the advancement of decentralized systems and the potential to reshape industries. Furthermore, investing in blockchain projects allows for diversification in an investment portfolio. With the ability to invest in various blockchain projects across different sectors, investors can spread their risk and potentially capitalize on the success of multiple projects. Overall, investing in blockchain projects presents a unique opportunity for individuals to not only generate financial gains but also contribute to the growth and development of this transformative technology.

Understanding Blockchain Technology

How does blockchain work?

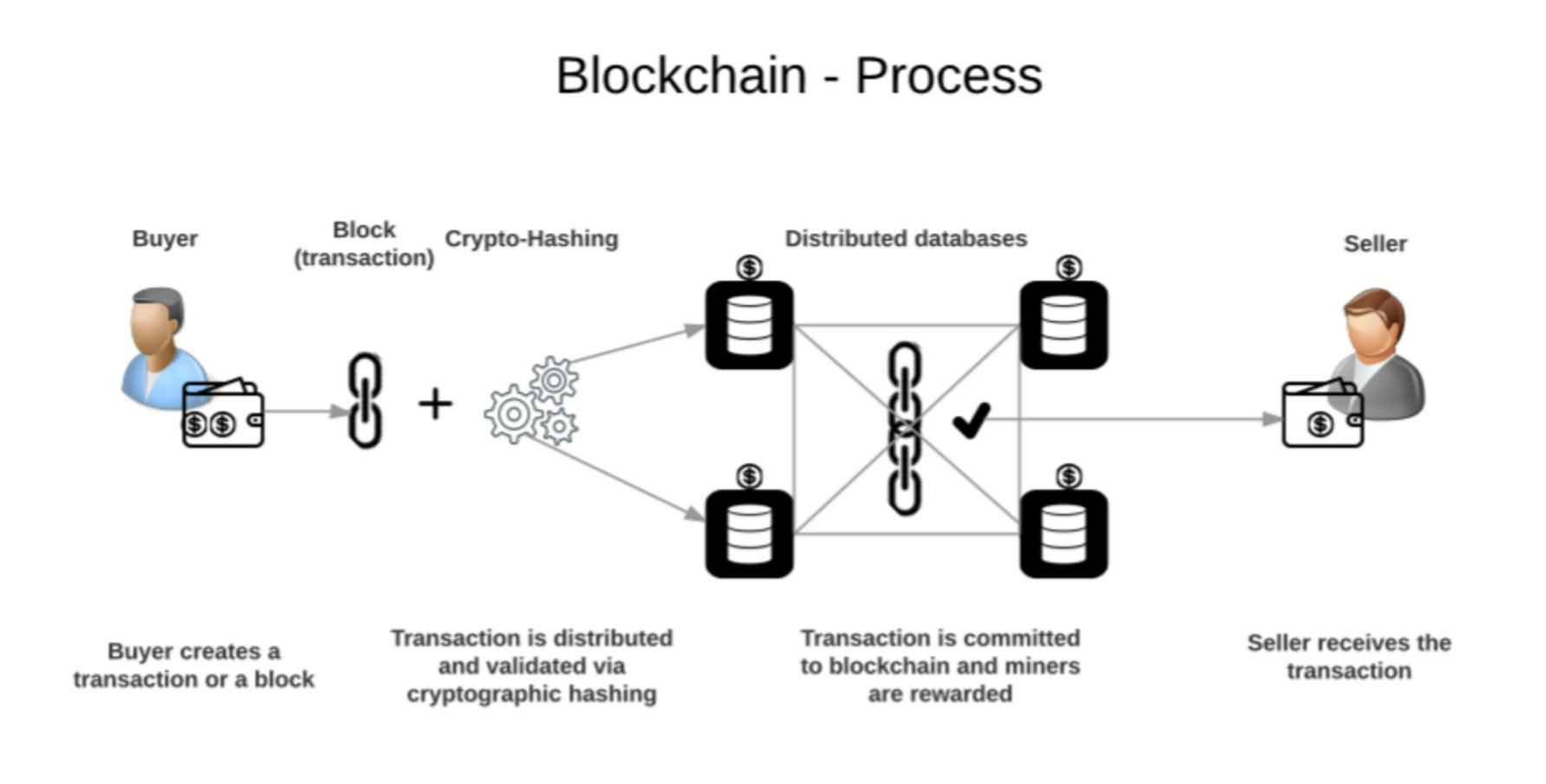

Blockchain is a decentralized technology that allows multiple parties to have a shared database without the need for a central authority. It works by creating a chain of blocks, where each block contains a list of transactions. These blocks are linked together using cryptography, ensuring the security and immutability of the data. When a new transaction is added to the blockchain, it is verified by the network of computers (nodes) and then added to a new block. This block is then added to the existing chain, creating a permanent and transparent record of all transactions. The distributed nature of blockchain ensures that no single entity has control over the entire network, making it resistant to censorship and tampering. Overall, blockchain technology has the potential to revolutionize various industries by providing transparent, secure, and efficient solutions.

Key components of blockchain

Blockchain technology consists of several key components that work together to ensure its functionality and security. The first component is a decentralized network, which allows multiple participants to have a copy of the blockchain and validate transactions. This decentralization ensures that no single entity has control over the entire network, making it more resistant to censorship and tampering. Another important component is cryptographic algorithms, which are used to secure and authenticate transactions and data on the blockchain. These algorithms provide a high level of security and ensure that transactions cannot be altered or forged. Additionally, blockchain technology relies on consensus mechanisms, such as proof-of-work or proof-of-stake, to reach agreement on the state of the blockchain. These mechanisms ensure that all participants in the network agree on the validity of transactions and prevent double-spending. Overall, these key components of blockchain work together to create a transparent, secure, and decentralized system for recording and verifying transactions.

Types of blockchain

Blockchain technology is revolutionizing various industries, and understanding the different types of blockchain is essential for any investor looking to enter this space. There are three main types of blockchain: public, private, and consortium. Public blockchains, such as Bitcoin and Ethereum, are open to anyone and allow for decentralized transactions and smart contracts. Private blockchains, on the other hand, are restricted to a specific group of participants and are often used by companies for internal purposes. Lastly, consortium blockchains are a hybrid between public and private blockchains, where a group of organizations come together to maintain and operate the network. Each type of blockchain has its own advantages and use cases, and investors should carefully consider which type aligns with their investment goals and risk tolerance.

Evaluating Blockchain Projects

Market analysis

Market analysis is a crucial step when it comes to investing in blockchain projects. It involves evaluating the current state of the market, identifying trends and patterns, and making informed decisions based on this information. By conducting a thorough market analysis, investors can gain valuable insights into the potential risks and opportunities associated with different blockchain projects. This analysis helps investors understand the demand for blockchain solutions, the competition in the market, and the potential for growth. It also allows investors to assess the viability of a project and determine its potential for long-term success. Therefore, it is essential for beginners to prioritize market analysis before making any investment decisions in the blockchain space.

Team and advisors

The success of any blockchain project heavily relies on the team and advisors involved. A strong and experienced team can bring valuable expertise and guidance to navigate the complex world of blockchain technology. When evaluating a project, it is important to assess the qualifications and track record of the team members and advisors. Look for individuals with a deep understanding of blockchain, as well as relevant industry experience. Additionally, consider the diversity of the team, as different perspectives can lead to more innovative solutions. By investing in projects with a capable and well-rounded team, beginners can increase their chances of success in the fast-growing blockchain space.

Technology and scalability

Blockchain technology has gained significant attention in recent years due to its potential to revolutionize various industries. One of the key aspects of blockchain technology is its scalability, which refers to its ability to handle a large number of transactions. Scalability is crucial for blockchain projects as it determines the speed and efficiency of the network. With advancements in technology, blockchain platforms are constantly working towards improving scalability to accommodate the growing demand. This has led to the development of various solutions such as sharding, layer 2 protocols, and off-chain transactions. These advancements in technology and scalability are essential for the widespread adoption of blockchain projects and the realization of their full potential.

Investment Strategies

Long-term vs short-term investments

When it comes to investing in blockchain projects, one of the key decisions to make is whether to focus on long-term or short-term investments. Long-term investments involve holding onto assets for an extended period, often years, with the expectation of significant returns in the future. On the other hand, short-term investments aim to take advantage of immediate market fluctuations and generate quick profits. Both approaches have their advantages and disadvantages, and it’s important for beginners to understand the differences and choose a strategy that aligns with their financial goals and risk tolerance.

Diversification

Diversification is a crucial strategy when it comes to investing in blockchain projects. By spreading your investments across different projects, you can mitigate the risks associated with any single project. This approach allows you to take advantage of the potential growth of multiple projects, while also minimizing the impact of potential losses. Diversification not only helps to protect your investment, but it also allows you to explore different sectors and technologies within the blockchain industry. This can provide you with a well-rounded portfolio that is positioned for long-term success in the ever-evolving world of blockchain.

Risk management

Risk management is a crucial aspect when it comes to investing in blockchain projects. As a beginner, it is important to understand the potential risks involved in this emerging technology. One of the main risks is the volatility of the cryptocurrency market, which can lead to significant fluctuations in the value of investments. It is essential to diversify your portfolio and not invest all your funds in a single project. Additionally, conducting thorough research and due diligence on the project team, technology, and market trends can help mitigate potential risks. Implementing proper risk management strategies, such as setting stop-loss orders and regularly monitoring your investments, can also minimize losses and protect your capital. By being aware of the risks and taking necessary precautions, beginners can navigate the world of blockchain investments more effectively and increase their chances of success.

Common Challenges and Risks

Regulatory uncertainty

Regulatory uncertainty is one of the key challenges that investors face when considering investing in blockchain projects. The rapid growth and innovation in the blockchain industry have outpaced the development of clear regulations and guidelines. This lack of regulatory clarity creates a level of uncertainty and risk for investors, as they are unsure about how their investments will be regulated and protected. However, despite the regulatory challenges, many investors are still attracted to blockchain projects due to the potential for high returns and the transformative nature of the technology. As the regulatory landscape continues to evolve, it is crucial for investors to stay informed and adapt their investment strategies accordingly.

Volatility

Volatility is a key characteristic of investing in blockchain projects. The cryptocurrency market is known for its extreme price fluctuations, which can be both a blessing and a curse for investors. On one hand, the high volatility presents opportunities for significant gains in a short period of time. On the other hand, it also carries the risk of substantial losses. Therefore, it is crucial for beginners to understand and manage the volatility associated with blockchain investments. This can be done through thorough research, diversification of investments, and setting realistic expectations. By being aware of the volatility and taking appropriate measures, investors can navigate the unpredictable nature of the blockchain market and make informed investment decisions.

Security risks

Blockchain technology offers many benefits, but it also comes with its fair share of security risks. As with any digital platform, there is always the potential for hacking, data breaches, and other cyber threats. In the world of blockchain, the decentralized nature of the technology can make it even more vulnerable to attacks. Smart contract vulnerabilities, 51% attacks, and phishing attempts are just some of the risks that investors should be aware of when investing in blockchain projects. It is crucial for investors to thoroughly research and understand the security measures implemented by a project before making any investment decisions. By staying informed and taking necessary precautions, investors can mitigate the risks associated with blockchain projects and make more informed investment choices.

Conclusion

Summary of key points

Blockchain technology has gained significant attention in recent years, and investing in blockchain projects has become increasingly popular. This article serves as a beginner’s guide to help individuals understand the key points to consider when investing in blockchain projects. The summary of key points includes understanding the fundamentals of blockchain technology, evaluating the project’s team and their expertise, assessing the project’s potential for growth and adoption, considering the project’s token economy and its utility, and conducting thorough research and due diligence before making any investment decisions. By following these key points, beginners can navigate the complex world of blockchain investing with more confidence and make informed investment choices.

Future outlook of blockchain projects

The future outlook of blockchain projects is highly promising. As the technology continues to evolve and mature, more industries are recognizing the potential of blockchain to revolutionize their operations. From finance to healthcare, supply chain to voting systems, blockchain has the potential to enhance transparency, security, and efficiency. With the increasing adoption of cryptocurrencies and the growing interest in decentralized finance, blockchain projects are expected to play a significant role in shaping the future of our digital economy. As more investors and businesses realize the potential returns and benefits of blockchain, the funding and support for these projects are likely to increase. Therefore, investing in blockchain projects can be a lucrative opportunity for beginners looking to capitalize on the future growth and innovation in this space.

Final thoughts

In conclusion, investing in blockchain projects can be an exciting and potentially lucrative opportunity for beginners. However, it is important to approach it with caution and do thorough research before making any investment decisions. The blockchain industry is still relatively new and rapidly evolving, with various risks and uncertainties. It is crucial to understand the technology, evaluate the project’s team and roadmap, and assess the market potential before committing any funds. Additionally, diversifying your investments and staying updated with the latest developments in the blockchain space can help mitigate risks and increase your chances of success. With proper due diligence and a long-term investment mindset, beginners can navigate the world of blockchain projects and potentially reap significant rewards.