Introduction

Definition of cross-border payments

Cross-border payments refer to financial transactions that occur between individuals, businesses, or financial institutions located in different countries. These transactions involve the transfer of funds across international borders, typically in different currencies. Cross-border payments play a crucial role in facilitating global trade and commerce, enabling businesses and individuals to send and receive money across borders for various purposes, such as purchasing goods and services, paying international suppliers, or transferring funds to family members living in different countries. With the advent of blockchain technology, new solutions have emerged to address the challenges and inefficiencies associated with cross-border payments, offering faster, more secure, and cost-effective alternatives to traditional banking systems.

Challenges in cross-border payments

Cross-border payments face several challenges that can hinder the efficiency and speed of transactions. One of the major challenges is the high cost associated with traditional banking systems. Banks often charge hefty fees for international transfers, making it expensive for individuals and businesses to send money across borders. Additionally, the lack of transparency in the payment process is another challenge. It is often difficult to track the status of a cross-border payment and verify that it has been successfully completed. Moreover, the lengthy settlement times can be frustrating for both senders and recipients, as it can take several days for the funds to reach the intended destination. These challenges highlight the need for innovative solutions, such as blockchain technology, to address the inefficiencies in cross-border payments and enhance the overall experience for users.

Importance of efficient cross-border payment solutions

Efficient cross-border payment solutions are of utmost importance in today’s globalized economy. With businesses and individuals conducting transactions across borders on a daily basis, the need for fast, secure, and cost-effective payment methods is crucial. Traditional cross-border payment systems often suffer from high fees, lengthy transaction times, and lack of transparency. However, blockchain technology has emerged as a promising solution to address these challenges. By leveraging decentralization, immutability, and smart contracts, blockchain-based cross-border payment solutions offer the potential for faster, cheaper, and more transparent transactions. This not only benefits businesses by reducing costs and increasing efficiency but also empowers individuals by providing them with greater control over their finances. As the world becomes increasingly interconnected, it is imperative to embrace innovative solutions like blockchain to facilitate seamless cross-border payments and drive economic growth.

Overview of Blockchain Technology

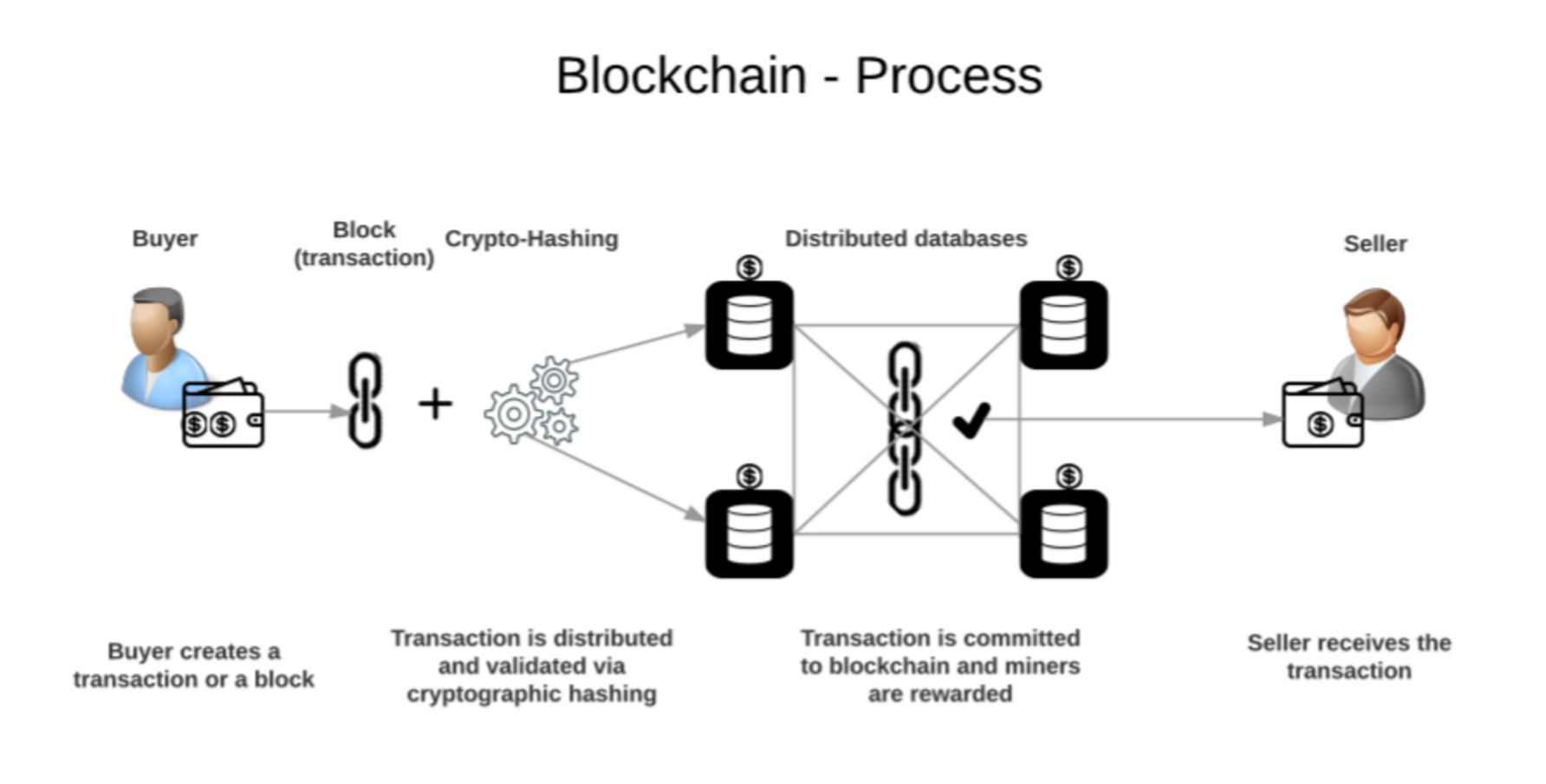

Explanation of blockchain technology

Blockchain technology is a decentralized and transparent digital ledger that securely records and verifies transactions across multiple computers. It provides a secure and efficient solution for cross-border payments by eliminating intermediaries, reducing costs, and increasing transaction speed. With blockchain, transactions can be processed in real-time, and the need for traditional banking systems can be minimized. Additionally, blockchain technology offers enhanced security and immutability, ensuring that transactions cannot be tampered with or reversed. Overall, blockchain solutions have the potential to revolutionize cross-border payments, making them faster, more secure, and more cost-effective.

Key features of blockchain

Blockchain technology offers several key features that make it an ideal solution for cross-border payments. Firstly, blockchain provides transparency and immutability, ensuring that all transactions are recorded and cannot be altered or tampered with. This enhances trust and reduces the risk of fraud. Secondly, blockchain enables faster and more efficient transactions by eliminating the need for intermediaries and streamlining the process. This can significantly reduce the time and cost involved in cross-border payments. Additionally, blockchain offers enhanced security through its decentralized nature, making it difficult for hackers to manipulate or compromise the system. Lastly, blockchain allows for greater financial inclusion by providing access to financial services for the unbanked and underbanked populations. Overall, the key features of blockchain make it a promising solution for improving the efficiency, security, and accessibility of cross-border payments.

Benefits of using blockchain for cross-border payments

Blockchain technology offers several benefits for cross-border payments. Firstly, it enables faster and more efficient transactions by eliminating the need for intermediaries and reducing the processing time. This not only saves time but also reduces costs associated with cross-border transactions. Additionally, blockchain provides increased transparency and security, as every transaction is recorded on a decentralized ledger that is accessible to all participants. This eliminates the risk of fraud and improves trust among parties involved in cross-border payments. Moreover, blockchain solutions can also improve financial inclusion by providing access to financial services for the unbanked population. Overall, the use of blockchain technology in cross-border payments has the potential to revolutionize the traditional banking system and streamline international transactions.

Existing Cross-Border Payment Systems

Traditional banking systems

Traditional banking systems have long been the primary method for facilitating cross-border payments. However, these systems are often slow, expensive, and prone to errors. Transactions can take days to process, and fees can be exorbitant. Additionally, the involvement of intermediaries increases the risk of fraud and security breaches. As a result, businesses and individuals are increasingly turning to blockchain technology as a more efficient and secure alternative for cross-border payments. Blockchain solutions offer faster transaction times, lower fees, and enhanced transparency. By eliminating the need for intermediaries, blockchain technology reduces the risk of fraud and provides a decentralized and immutable ledger that ensures the integrity of transactions. With its potential to revolutionize the cross-border payment landscape, blockchain is poised to disrupt traditional banking systems and drive innovation in the financial industry.

SWIFT network

The SWIFT network, which stands for Society for Worldwide Interbank Financial Telecommunication, has been the dominant player in cross-border payments for decades. It is a messaging network that enables banks and financial institutions to securely exchange information and instructions for international transactions. However, the traditional SWIFT network has faced challenges in terms of speed, transparency, and cost-effectiveness. With the emergence of blockchain technology, there is a growing interest in exploring blockchain solutions for cross-border payments to overcome these limitations. Blockchain offers the potential to streamline and automate the cross-border payment process, reducing transaction times, improving transparency, and lowering costs. By leveraging distributed ledger technology, blockchain solutions can provide a more efficient and secure alternative to the traditional SWIFT network.

Payment service providers

Payment service providers play a crucial role in facilitating cross-border payments. With the advent of blockchain technology, these providers now have access to more efficient and secure solutions. Blockchain enables payment service providers to streamline processes, reduce costs, and increase transparency in cross-border transactions. By leveraging the decentralized nature of blockchain, payment service providers can eliminate intermediaries, minimize settlement times, and ensure the integrity of transactions. Additionally, blockchain technology provides increased security by encrypting and storing transaction data across multiple nodes, making it nearly impossible for fraudulent activities to occur. As a result, payment service providers are able to offer faster, cheaper, and more reliable cross-border payment services to their customers.

Blockchain Solutions for Cross-Border Payments

Decentralized payment networks

Decentralized payment networks are revolutionizing the way cross-border payments are conducted. With the advent of blockchain technology, traditional intermediaries such as banks and payment processors are being bypassed, allowing for faster, more secure, and cost-effective transactions. These networks operate on a peer-to-peer basis, with participants directly interacting with each other, eliminating the need for third-party involvement. By removing centralized control, decentralized payment networks offer increased transparency and trust, as every transaction is recorded on the blockchain and can be verified by all participants. This innovative approach to cross-border payments has the potential to significantly reduce transaction fees, increase transaction speed, and improve financial inclusion for individuals and businesses around the world.

Smart contracts for automated transactions

Smart contracts are an integral part of blockchain solutions for cross-border payments. These self-executing contracts are programmed to automatically execute transactions when certain predefined conditions are met. By eliminating the need for intermediaries and manual processing, smart contracts enable faster and more efficient cross-border payments. They provide transparency, security, and immutability, ensuring that transactions are conducted in a trustless and tamper-proof manner. With smart contracts, parties involved in cross-border transactions can have greater confidence in the reliability and accuracy of the payment process, leading to reduced costs and increased efficiency.

Cryptocurrencies for instant settlements

Cryptocurrencies have emerged as a game-changing solution for instant settlements in cross-border payments. With their decentralized nature and secure blockchain technology, cryptocurrencies enable transactions to be completed quickly and efficiently, eliminating the need for intermediaries and reducing transaction costs. This has revolutionized the traditional cross-border payment system, which often involves delays and high fees. By leveraging cryptocurrencies, individuals and businesses can now send and receive payments instantly, regardless of geographical boundaries. Moreover, the transparency and immutability of blockchain technology ensure the security and integrity of these transactions, making cryptocurrencies a reliable and trustworthy option for cross-border settlements.

Advantages of Blockchain Solutions

Reduced costs and fees

Reduced costs and fees are one of the key advantages of using blockchain solutions for cross-border payments. Traditional methods of transferring money across borders often involve multiple intermediaries, each charging their own fees, which can quickly add up. With blockchain technology, transactions can be executed directly between parties, eliminating the need for intermediaries and reducing associated costs. Additionally, blockchain solutions can streamline the payment process, reducing the time and effort required for cross-border transactions. This not only saves businesses money but also improves efficiency and transparency in the payment ecosystem. Overall, the use of blockchain for cross-border payments offers significant cost savings and benefits for businesses and individuals alike.

Increased transaction speed

Blockchain technology has revolutionized the way cross-border payments are conducted, providing increased transaction speed. Traditionally, cross-border payments have been slow and cumbersome, often taking several days to complete. However, with blockchain solutions, transactions can be processed and settled in a matter of minutes. This is achieved through the use of decentralized ledgers and smart contracts, which eliminate the need for intermediaries and streamline the payment process. The increased transaction speed offered by blockchain solutions not only improves efficiency but also enhances the overall user experience, making cross-border payments faster and more convenient than ever before.

Enhanced security and transparency

Blockchain technology offers enhanced security and transparency for cross-border payments. With traditional payment systems, there is always a risk of fraud or unauthorized access to sensitive information. However, blockchain ensures that transactions are secure and tamper-proof through its decentralized and immutable nature. By recording every transaction on a distributed ledger, blockchain provides transparency, allowing all parties involved to verify and track the movement of funds in real-time. This increased transparency not only reduces the risk of fraud but also improves trust and confidence in cross-border payments. Furthermore, blockchain eliminates the need for intermediaries, reducing costs and improving efficiency. Overall, the adoption of blockchain solutions in cross-border payments can revolutionize the financial industry by providing a more secure, transparent, and efficient payment ecosystem.

Challenges and Limitations

Regulatory concerns

Regulatory concerns play a crucial role in the adoption and implementation of blockchain solutions for cross-border payments. As blockchain technology continues to disrupt traditional financial systems, regulators are faced with the challenge of striking a balance between fostering innovation and ensuring consumer protection. One of the main concerns is the potential for money laundering and terrorist financing through anonymous transactions on the blockchain. To address this, regulatory frameworks are being developed to enhance transparency and establish compliance standards for blockchain-based payment systems. Additionally, issues related to data privacy, cross-border jurisdiction, and legal enforceability of smart contracts are also important considerations. Despite these challenges, regulators recognize the transformative potential of blockchain technology and are actively working towards creating a conducive regulatory environment that encourages innovation while safeguarding the integrity of cross-border payments.

Scalability issues

Scalability issues have been a major challenge in the world of blockchain technology, particularly when it comes to cross-border payments. As the number of transactions on the blockchain network increases, the system can become overwhelmed, leading to slower transaction times and higher fees. This has hindered the widespread adoption of blockchain solutions for cross-border payments, as businesses and individuals require fast and cost-effective transactions. However, developers and researchers are actively working on various scalability solutions, such as layer 2 protocols and sharding, to address these issues and improve the efficiency of cross-border payments using blockchain technology.

Integration with existing systems

Integration with existing systems is a crucial aspect when it comes to implementing blockchain solutions for cross-border payments. In order to ensure a seamless transition and maximize the benefits of blockchain technology, it is essential for organizations to integrate their existing systems with the new blockchain infrastructure. This integration allows for the secure and efficient transfer of data and funds between different systems, enabling real-time settlement and reducing the need for intermediaries. By leveraging blockchain technology, organizations can streamline their cross-border payment processes, reduce costs, and enhance transparency and traceability.