Introduction

Definition of blockchain

Blockchain is a decentralized and distributed ledger technology that allows multiple parties to maintain a shared database without the need for a central authority. It is designed to be transparent, secure, and immutable, making it an ideal solution for recording and verifying transactions. The technology behind blockchain relies on cryptographic algorithms to ensure the integrity and privacy of data. By eliminating the need for intermediaries, blockchain has the potential to revolutionize various industries, including finance, supply chain management, and healthcare.

Importance of blockchain technology

Blockchain technology has gained significant attention in recent years due to its potential to revolutionize various industries. The importance of blockchain technology lies in its ability to provide secure and transparent transactions, eliminating the need for intermediaries. This decentralized approach not only enhances efficiency but also reduces costs and enhances trust among participants. Additionally, blockchain technology has the potential to address various legal and regulatory challenges, such as ensuring data privacy, preventing fraud, and facilitating compliance with regulations. As governments and organizations recognize the significance of blockchain technology, understanding its legal implications becomes crucial for ensuring its responsible and ethical use.

Overview of blockchain regulations

Blockchain regulations are a set of rules and guidelines that govern the use and implementation of blockchain technology. As blockchain continues to gain popularity and disrupt various industries, governments around the world are grappling with how to regulate this innovative technology. The goal of blockchain regulations is to strike a balance between fostering innovation and ensuring consumer protection, privacy, and security. These regulations cover a wide range of areas, including data privacy, financial transactions, identity verification, and smart contracts. It is crucial for businesses and individuals involved in blockchain to stay informed about the evolving regulatory landscape to navigate the legal implications and ensure compliance.

Understanding Blockchain Technology

How blockchain works

Blockchain is a decentralized technology that enables the secure and transparent transfer of digital assets. It works by creating a chain of blocks, where each block contains a list of transactions. These transactions are validated by a network of computers, known as nodes, and once validated, they are added to the blockchain. The blockchain is maintained by a consensus mechanism, which ensures that all participants agree on the validity of the transactions. This makes blockchain resistant to tampering and fraud. Additionally, blockchain uses cryptography to secure the data, making it virtually impossible to alter or manipulate. Overall, blockchain technology revolutionizes the way transactions are conducted, providing a trustless and efficient system for various industries.

Key features of blockchain

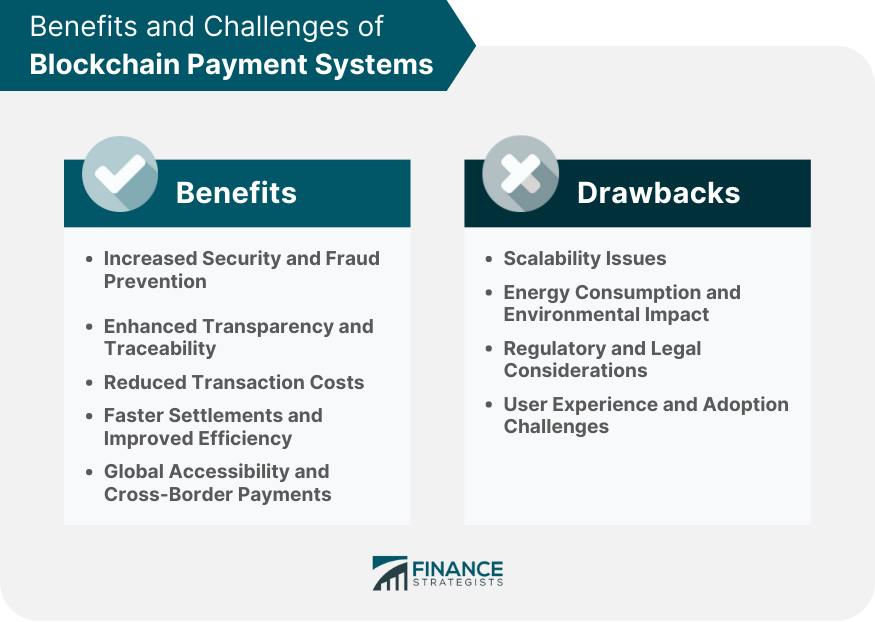

Blockchain technology has several key features that make it unique and revolutionary. One of the key features is decentralization, which means that there is no central authority or intermediary controlling the transactions. This not only increases transparency but also reduces the risk of fraud and manipulation. Another important feature is immutability, which means that once a transaction is recorded on the blockchain, it cannot be altered or deleted. This ensures the integrity and security of the data stored on the blockchain. Additionally, blockchain technology is also known for its efficiency and cost-effectiveness, as it eliminates the need for intermediaries and reduces transaction costs. These key features of blockchain have significant implications for regulations and legal frameworks, as they challenge traditional systems and require new approaches to address issues such as privacy, data protection, and liability.

Types of blockchain

Blockchain technology can be categorized into various types based on their structure and functionality. The most common types of blockchain include public blockchains, private blockchains, and consortium blockchains. Public blockchains are open and decentralized networks where anyone can participate and validate transactions. Private blockchains, on the other hand, are restricted to a specific group of participants and are often used by organizations for internal purposes. Consortium blockchains are a hybrid of public and private blockchains, where a group of organizations jointly govern the network. Each type of blockchain has its own advantages and legal implications, which need to be considered when implementing blockchain technology.

Legal Implications of Blockchain

Data privacy and security

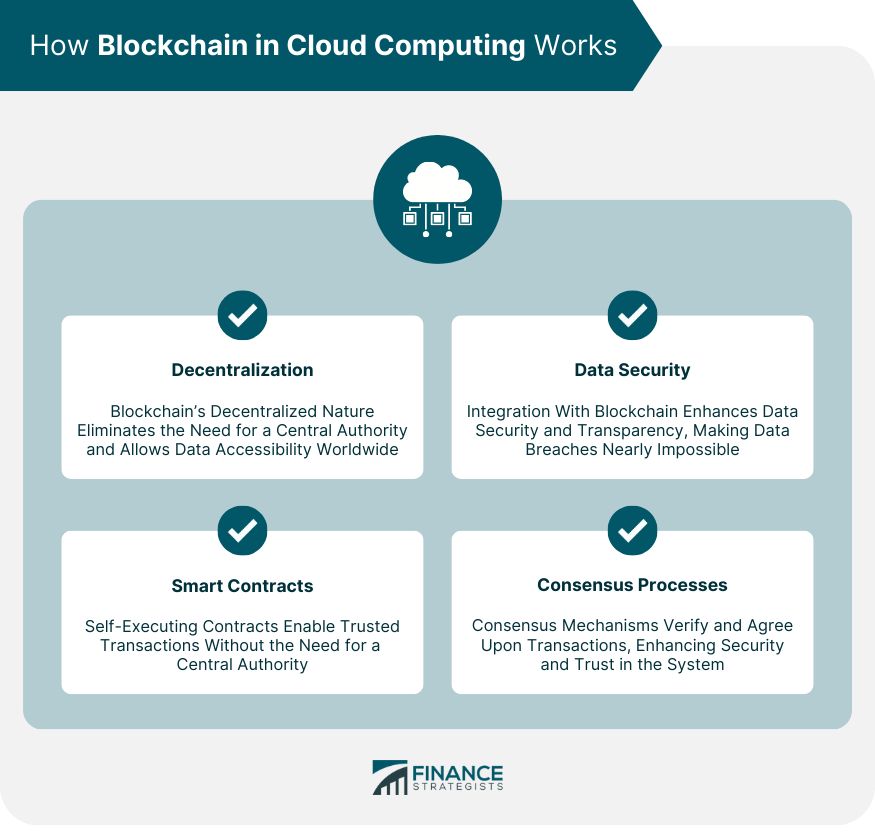

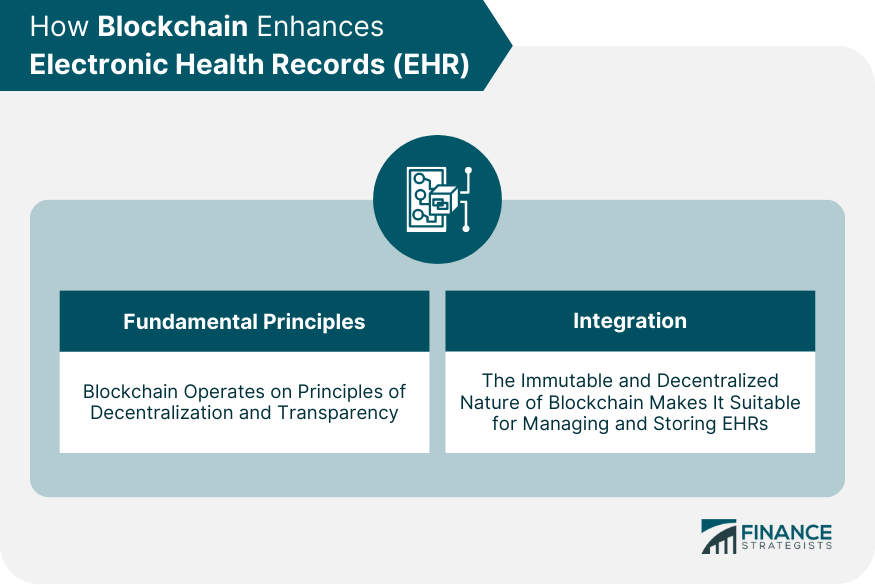

Data privacy and security are crucial considerations in the world of blockchain technology. As blockchain networks store and transmit sensitive information, it is essential to ensure that data is protected from unauthorized access and tampering. Blockchain technology offers several features that enhance data privacy and security, such as encryption, immutability, and decentralized storage. These features make it difficult for malicious actors to alter or manipulate data, providing a higher level of trust and integrity. However, it is important to note that while blockchain technology provides robust security measures, it is not immune to vulnerabilities. Therefore, it is crucial for organizations and regulators to establish proper frameworks and regulations to address potential risks and protect user data in the blockchain ecosystem.

Smart contracts and legal enforceability

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automatically execute transactions and enforce the agreed-upon terms without the need for intermediaries. However, when it comes to legal enforceability, there are certain challenges that arise. One of the main concerns is the lack of clarity in traditional legal frameworks regarding the recognition and enforceability of smart contracts. As blockchain technology continues to evolve, regulators and legal experts are working towards developing new laws and regulations to address these challenges and ensure the legal validity of smart contracts. It is crucial for businesses and individuals to understand the current and future regulatory landscape surrounding smart contracts to navigate the legal implications effectively.

Intellectual property rights

Blockchain technology has introduced new challenges and opportunities in the realm of intellectual property rights. With the decentralized and transparent nature of blockchain, the traditional methods of protecting intellectual property face significant changes. On one hand, blockchain provides a secure and immutable platform for creators to register their works and establish ownership. On the other hand, it also raises concerns about the infringement of intellectual property rights through unauthorized use and distribution of digital assets. As blockchain continues to evolve, it is crucial for legal frameworks to adapt and address the unique legal implications surrounding intellectual property rights in the digital age.

Regulatory Challenges

Lack of standardized regulations

The lack of standardized regulations is a significant challenge in the world of blockchain. As a relatively new technology, blockchain operates in a legal gray area in many jurisdictions. This lack of clarity and consistency in regulations creates uncertainty for businesses and individuals who want to adopt blockchain solutions. Without standardized regulations, there is a risk of conflicting laws and regulations across different regions, making it difficult for companies to operate globally. Additionally, the absence of clear guidelines can hinder innovation and investment in the blockchain space. To address this issue, it is crucial for governments and regulatory bodies to collaborate and establish clear, consistent, and internationally recognized regulations for blockchain technology.

Jurisdictional issues

Jurisdictional issues play a crucial role in the regulation of blockchain technology. As blockchain operates on a decentralized network, it poses challenges for traditional legal frameworks that are based on centralized control. The global nature of blockchain also raises questions about which jurisdiction has authority over blockchain transactions and activities. Different countries have adopted various approaches to regulate blockchain, with some embracing it as a technological innovation while others imposing strict regulations to mitigate risks. This complex landscape of jurisdictional issues creates a need for harmonization and collaboration among countries to develop consistent and effective blockchain regulations.

Compliance with anti-money laundering laws

Compliance with anti-money laundering laws is a crucial aspect of blockchain regulations and has significant legal implications. As blockchain technology continues to gain traction, governments around the world are implementing strict AML (anti-money laundering) laws to prevent illicit activities, such as money laundering and terrorist financing. Blockchain-based platforms and cryptocurrencies have the potential to facilitate anonymous transactions, making them attractive to individuals seeking to evade AML regulations. To ensure compliance, companies operating in the blockchain space must implement robust AML procedures, including customer due diligence, transaction monitoring, and reporting suspicious activities. Failure to comply with these regulations can result in severe penalties and legal consequences. Therefore, understanding and adhering to AML laws is essential for businesses operating in the blockchain industry.

Current Blockchain Regulations

Regulatory approaches in different countries

Blockchain regulations and legal implications vary across different countries. While some countries have embraced blockchain technology and adopted a supportive regulatory framework, others have taken a more cautious approach. In the United States, for example, there is a patchwork of regulations at both the federal and state levels, with different agencies having jurisdiction over different aspects of blockchain. On the other hand, countries like Switzerland and Malta have positioned themselves as blockchain-friendly jurisdictions, offering clear regulations and attractive incentives for blockchain companies. In China, the government has imposed strict regulations on cryptocurrency trading and initial coin offerings (ICOs), while still recognizing the potential of blockchain technology. Overall, the regulatory landscape for blockchain is constantly evolving, with countries adapting their approaches to balance innovation and consumer protection.

Key regulations for cryptocurrency exchanges

Cryptocurrency exchanges are subject to a number of key regulations that aim to ensure the security and integrity of the digital asset market. One of the most important regulations is Know Your Customer (KYC) requirements, which require exchanges to verify the identity of their users. This helps prevent money laundering, fraud, and other illicit activities. Additionally, exchanges must comply with Anti-Money Laundering (AML) regulations, which involve implementing robust monitoring and reporting systems to detect and prevent suspicious transactions. Another key regulation is the requirement for exchanges to obtain licenses from relevant regulatory bodies, such as the Securities and Exchange Commission (SEC) or the Financial Conduct Authority (FCA). These licenses ensure that exchanges operate within the legal framework and meet certain standards of security and consumer protection. Overall, these regulations play a crucial role in safeguarding the interests of investors and maintaining the integrity of the cryptocurrency market.

Regulatory frameworks for initial coin offerings (ICOs)

Regulatory frameworks for initial coin offerings (ICOs) play a crucial role in shaping the blockchain industry. As ICOs have gained popularity as a method of crowdfunding for blockchain projects, regulators around the world have started to establish guidelines and regulations to protect investors and maintain market integrity. These frameworks aim to ensure transparency, accountability, and compliance with existing laws and regulations. By providing a clear set of rules, regulatory frameworks for ICOs help to foster investor confidence and promote the growth of the blockchain ecosystem. However, striking the right balance between innovation and investor protection remains a challenge for regulators, as they navigate the rapidly evolving landscape of blockchain technology and its associated risks.

Future of Blockchain Regulations

Emerging trends in blockchain regulations

Emerging trends in blockchain regulations are shaping the legal landscape for this revolutionary technology. Governments around the world are recognizing the potential of blockchain and are enacting new laws and regulations to support its development and adoption. One of the key trends is the focus on consumer protection and privacy. As blockchain applications become more widespread, authorities are keen to ensure that individuals’ personal information is safeguarded and that they have control over how their data is used. Another emerging trend is the establishment of regulatory sandboxes, which provide a controlled environment for blockchain startups to test their innovative solutions without being burdened by excessive regulations. These sandboxes allow for experimentation and collaboration between regulators and industry players, fostering innovation while maintaining regulatory oversight. Additionally, there is a growing emphasis on international cooperation and harmonization of blockchain regulations. As blockchain technology transcends geographical boundaries, regulators are working together to develop common standards and frameworks to facilitate cross-border transactions and ensure regulatory compliance. Overall, the emerging trends in blockchain regulations reflect a concerted effort to strike a balance between fostering innovation and protecting the interests of stakeholders, paving the way for the widespread adoption of blockchain technology.

Potential impact of blockchain on existing legal systems

Blockchain technology has the potential to revolutionize existing legal systems in various ways. One of the key impacts is the decentralization of authority, as blockchain operates on a distributed network without the need for a central governing body. This could lead to a shift in power from traditional legal institutions to the users of blockchain platforms, as they become more empowered to enforce contracts and resolve disputes through smart contracts and decentralized arbitration. Additionally, blockchain’s immutability and transparency can enhance the efficiency and trustworthiness of legal processes, such as document verification, property rights registration, and supply chain management. However, this disruptive technology also raises several legal challenges, including data privacy, identity verification, jurisdictional issues, and regulatory compliance. As blockchain continues to evolve, it is crucial for legal systems to adapt and develop frameworks that address these complexities while harnessing the potential benefits of this innovative technology.

Collaboration between regulators and industry stakeholders

Collaboration between regulators and industry stakeholders is crucial in establishing effective blockchain regulations and addressing the legal implications associated with this innovative technology. As blockchain continues to disrupt various industries, it is essential for regulators to work closely with industry stakeholders to understand the intricacies of blockchain and its potential impact. By collaborating, regulators can ensure that regulations are both comprehensive and adaptable, taking into account the unique characteristics of blockchain while also addressing concerns around privacy, security, and consumer protection. Additionally, industry stakeholders can provide valuable insights and expertise to help shape regulations that foster innovation while also mitigating risks. This collaborative approach will not only enhance regulatory clarity but also foster an environment that encourages responsible blockchain adoption and growth.